Government Loans

Consumers No Longer Fear Applying For A Mortgage

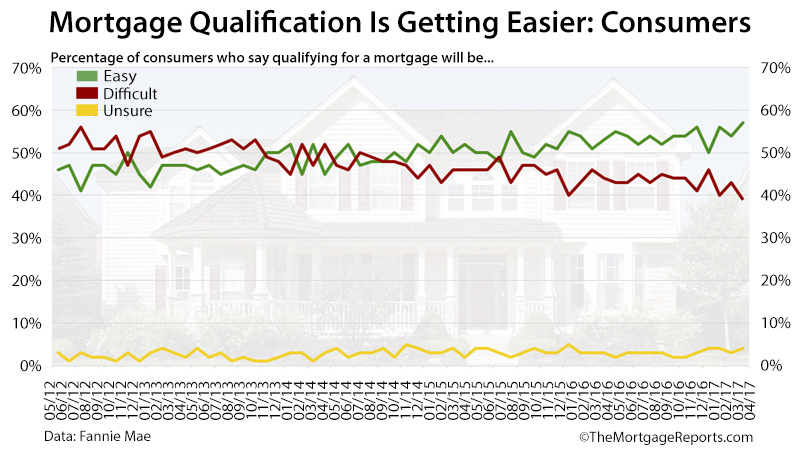

Less than five years ago, only 4-in-10 consumers thought it would be easy to get a mortgage.

That's understandable.

Lenders were still recovering from the Great Recession. Home prices were dropping in many areas of the country. Only top-echelon borrowers were getting approved.

But, my, how things have changed.

Lenders are approving loans down to 580 credit scores and mortgage companies are loosening standards rapidly.

Home values are rising. Houses that were once underwater now have decent equity -- more than enough for a standard refinance.

Perhaps most important, people have jobs with which to qualify for a home loan.

This year, confidence rules the market, not fear. Now, nearly 60% of consumers think it would be "easy" to qualify for a mortgage.

Click to see today's rates (May 18th, 2017) Study Reveals Growing Confidence Among Potential Mortgage Shoppers

Once each month, the country's largest mortgage agency, Fannie Mae, publishes its National Housing Survey.

It polls 1,000 consumers each month, asking each respondent more than one hundred questions about the future of housing, mortgage rates, and the state of the economy.

One hundred thousand questions later, Fannie Mae compiles the report. In April, the results were surprising: it revealed consumers are not as fearful of applying for a mortgage as they used to be.

In July 2012, consumers were more pessimistic about getting a mortgage than any time since Fannie Mae started collecting data. Just 41% believed it would be easy to get a mortgage.

These were probably borrowers with high-paying jobs despite the recession, and great credit scores. For some home purchase and refinance applicants, it will always be "no sweat" to get a loan.

The problem was, not everyone is as fortunate.

That month, 56% said it would be "difficult" to get a loan to buy or refinance property. These were likely applicants to which lenders were unwilling to lend, for a number of reasons:

- Small down payment available

- Low credit scores

- No money in the bank after closing

- Inadequate income

- High debt, including student debt

These issues are fading. Fannie Mae's most recent report in April revealed that 57% of consumers believe it would be easy to get a mortgage -- a survey high.

Recently, new provisions have rolled out addressing each of the above "problems" that face mortgage consumers. Those wanting to finally buy a home -- or refinance into the best rate possible -- now have a very good chance of doing so.

Click to see today's rates (May 18th, 2017) Making A Down Payment: The Choice Is Yours

Down payments are optional. Many loans today offer between 0% and 5% down.

Many mortgage consumers assume they need at least 10-20% down to qualify, but that's not the case. Years ago, low-down-payment loans were harder to come by. Fannie Mae and Freddie Mac required sky-high credit scores for their low-down options.

Lenders were quite strict about FHA and VA loans, too.

Now, lenders are making concessions to attract these home buyers. With the recent rise in rates, lenders are eager for purchase business and lowering qualification standards to realistic levels.

Use this calculator to determine which loan type is best for you based on your down payment, then keep reading about more qualification issues, and how they're getting easier.

USDA mortgage

The USDA loan is the best-kept secret in the mortgage market. It requires zero down, plus credit guidelines are loose. Eligibility is location-based. Many rural and suburban neighborhoods across the U.S. are USDA-eligible. This loan is perfectly suited for first-time and repeat buyers, and you don’t have to have a high income to qualify.

Check your USDA eligibility now VA home loan

The VA home loan is available to home buyers with eligible military experience -- as little as 90 days of service in some cases. This mortgage option has no down payment requirement. Plus, no mortgage insurance is required, potentially saving buyers hundreds per month.

Check your VA loan eligibility status now HomeReady™

This loan allows entire households to contribute to the mortgage payment. The primary buyer can use income from non-borrowing household members to qualify. Income from roommates, boarders, and mother-in-law units is allowed. This loan requires a small 3% down payment, all of which can come from a gift from a family member or other eligible source.

Get preapproved via the HomeReady™ loan Conventional 97

The Conventional 97 gets its name from its small 3% down payment requirement. This program is best for home buyers who would otherwise qualify for a standard conventional loan, but don’t want to make a large down payment. Fannie Mae and Freddie Mac sponsor the program, which makes it widely available nationwide.

Get a Conventional 97 loan approval here FHA Loan

The FHA mortgage is the go-to program for more than 20% of home buyers. It requires a small down payment and is well-suited for borrowers with imperfect credit histories or lower income. This is a government-sponsored program designed to get more people into their own homes. Therefore, guidelines are flexible, and buyers often qualify when they thought they could never own a home.

Check your FHA eligibility here Conventional 95

Standard conventional loans come with a 5% down feature that not a lot of buyers know about. Many assume loans sponsored by Fannie Mae and Freddie Mac come with a 20% down requirement, but that’s not the case. Ask your lender about the 5% program, and enjoy the benefits of a conventional loan without the steep down payment requirement.

Check your Conventional 95 eligibility now 80-10-10

An 80-10-10 loan, otherwise known as a “piggyback” loan, is a mortgage option in which a home buyer receives a first and second mortgage simultaneously: one for 80% of the purchase price, and one for 10%. One loan “piggybacks” on top of the other. No mortgage insurance is required because the lender considers the 10% second mortgage part of the buyer’s down payment..

Check your 80-10-10 rates now Conventional Loan

You can put just 10% down on a conventional loan, despite the popular belief that these loans require 20%. This option requires private mortgage insurance (PMI), which is typically very affordable. In many cases, opting for PMI is a better strategy than trying to come up with 20% down.

Check your conventional loan rates now Conventional Loan

Conventional loans come with very low rates, plus no mortgage insurance is required when you put 20% down. Conventional loans are sponsored by Fannie Mae and Freddie Mac and available at your local lender. Conventional loans remain the mortgage of choice for buyers with good credit and a healthy down payment. A conventional 20% down loan can also be used to buy a second home or investment property.

Get Pre-Approved For Your Conventional Loan Multi-unit & investment properties

You can buy a duplex, triplex, or four-plex by making a down payment of 25% or more. Purchasing a multi-unit home is a great way to get started as a landlord, whether you plan to live in one of the units or rent out the entire building. Homes with up to four units are eligible for conventional lending.

Get Pre-Approved For An Investment Property Now

Don't have a lot saved for a down payment? That might be less of a problem than you think

Click to see today's rates (May 18th, 2017) Consumers Worry Less About Low Credit Scores

Back in 2012, credit scores were a sticking point for many would-be mortgage applicants.

Between 2008 and 2010, over 8 million Americans lost their jobs, according to the Bureau of Labor Statistics. That led to missed mortgage payments, late auto loans, and other credit accounts in default.

Consumers with nearly perfect credit suddenly had basement-level scores in the 500s.

Mercifully, many people have worked their way out of severe credit issues. Also helping: lenders are relaxing credit score standards.

Not many consumers know that the official minimum credit score for an FHA loan is 500 (if you put 10% down). But not many lenders will go that low. Still, some lenders in the marketplace today will consider and approve scores down to 580 and only require 3.5% down at that credit level.

VA home loans, reserved for current and past military service persons, have no published minimum score at all.

Following are minimum credit scores for each type of loan.

- FHA: 580 for 3.5% down

- VA: no published minimum

- USDA: typically 640

- Conventional loans: 620

- Jumbo loans: usually 660-700

Now, more lenders have the freedom to issue loans to applicants with banged up credit.

But it wasn't always this way. According to data from Ellie Mae, one of the nation's largest loan software providers, lenders are "easing up" significantly.

At the start of 2012 the average credit score of a closed loan nationwide was 750. The average "denied" loan was around 700.

Yes: people with 700 and higher credit scores were being denied. That is considered a "good" credit score.

Fast forward to 2017. The average FICO score is now around 720 -- a thirty-point improvement from five years ago. That's very close to the former average FICO score for denied loans.

Prospective mortgage applicants aren't aware of this, though. Many have been turned down, and assume nothing has changed. Well, a lot has changed. Unless they go and apply for a mortgage, they might never know that they are now perfectly qualified for a mortgage.

Money In The Bank: Optional

It's true that some loan programs -- cash-out loans and investment property refinances, for instance -- require cash reserves, a.k.a. "money in the bank" to qualify.

For instance, lenders might need you to prove you have two months' worth of principal, interest, taxes, and insurance for the property saved in reserve.

But many home purchase and refinance programs require $0 saved to qualify.

- FHA home purchase: no personal assets required if you receive a gift

- VA home purchase: zero down payment required. No reserves required

- Conventional loans: 100% of the down payment and closing costs can come from a gift

- USDA loans: no down payment or extra funds needed; closing costs can be paid by the seller or via a gift

Similarly, many refinance options require no extra funds in the bank, unless you have closing costs that you didn't roll into the new loan.

For most loan programs today, having spare cash in savings is optional. It's no longer the barrier to home financing that it once was.

Income: Sometimes, It Doesn't Matter

Ten years ago, you could buy a home with no income.

"Stated income loans" were all the rage. For those loans, you merely stated your income, and the lender took you at your word.

New regulation made those programs mostly a thing of the past for home purchases. But, refinancing -- well, that's a different story.

Many refi programs today simply don't ask you to verify income. Programs in which you are replacing an existing loan with the same type of loan often require reduced documentation.

- FHA streamline refinance: no income verified

- VA streamline refinance: no income verified

- HARP mortgage: no income verified if you have 12 months of the new full home payment in savings.

- USDA streamlined-assist refinance: no income verified

If you are planning to refinance, and have an FHA, VA, conventional, or USDA loan, check the streamlined options above.

For home buyers, you will likely have to verify your income. But, lenders will not be as nit-picky as they were five years ago.

Self-employed borrowers may only need one year of tax returns instead of two, for instance. And, salaried borrowers may not need tax returns at all.

In short, you no longer need to bring a mountain of documentation when you apply for a loan. This is resulting in an attitude shift among consumers: mortgages are no longer "difficult" to get.

Click to see today's rates (May 18th, 2017) Relief For Applicants With High Student Debt

One of the most significant developments of 2017 is the easing of standards for those holding student debt.

No doubt this is affecting how easily consumers think they can get a mortgage.

Earlier this year, Fannie Mae rolled out Student Loan Solutions -- a loan program that looks at student loan payments differently compared to other debt.

In the past, the lender would "hit" the borrower with the full payment for the student loans, regardless of whether the student was paying that amount.

For instance, students on income-driven repayment (IDR) programs might pay $250 per month in "real life", but would owe $750 per month if on a full repayment plan.

Lenders will now accept the lower payment for qualification.

Additionally, student loan debt -- or any debt -- paid by others over the past 12 months doesn't need to be factored in at all.

These changes make it easier for graduates who are close to the typical 43% debt-to-income ratio limit (debt payments equal to $430 per month for every $1,000 in income).

It's no wonder that today's younger home buyers are saying it's much easier to get qualified now than it was just a few years ago.

How Do I Check My Eligibility To Buy Or Refi A Home?

Qualifying for a mortgage has never been easier during this decade.

Eligibility checks are readily available and come with a personalized rate quote. You could be surprised at what you qualify for.

Arthur Credit Full Beaker